There are lots of reasons to look at revenue per employee (RPE). It is a good benchmark for evaluating the efficiency of firms that operate in the same sector. For example, RPE will be less in people-intensive sectors (e.g. Retail, Professional Services) than in capital-intensive sectors (mining, technology).

The arithmetic for deriving it is simple:

So, if you own a privately held firm that you plan to sell to retire, then you’ll want to ensure that you have a high Revenue per Employee relative to others in the industry (that could theoretically be purchased).

What drives RPE?

While there are many factors, here are a five to consider:

- Business sector – a company in a “hot” business sector will attract demand for its offerings, e.g. cloud, mobile enablement

- A company’s competitive “moat” – its offerings are uniquely differentiated in the market, can command a high price and margin, and are difficult for competitors to match in the short term

- Skilled employees – a cadre of functionally skilled, effective employees inevitably gets more home runs than the competition. Plus, they are hard to find to begin with.

- Management – knowing how to attract and retain a productive team, and to coax efficiencies – and margin – out of work processes.

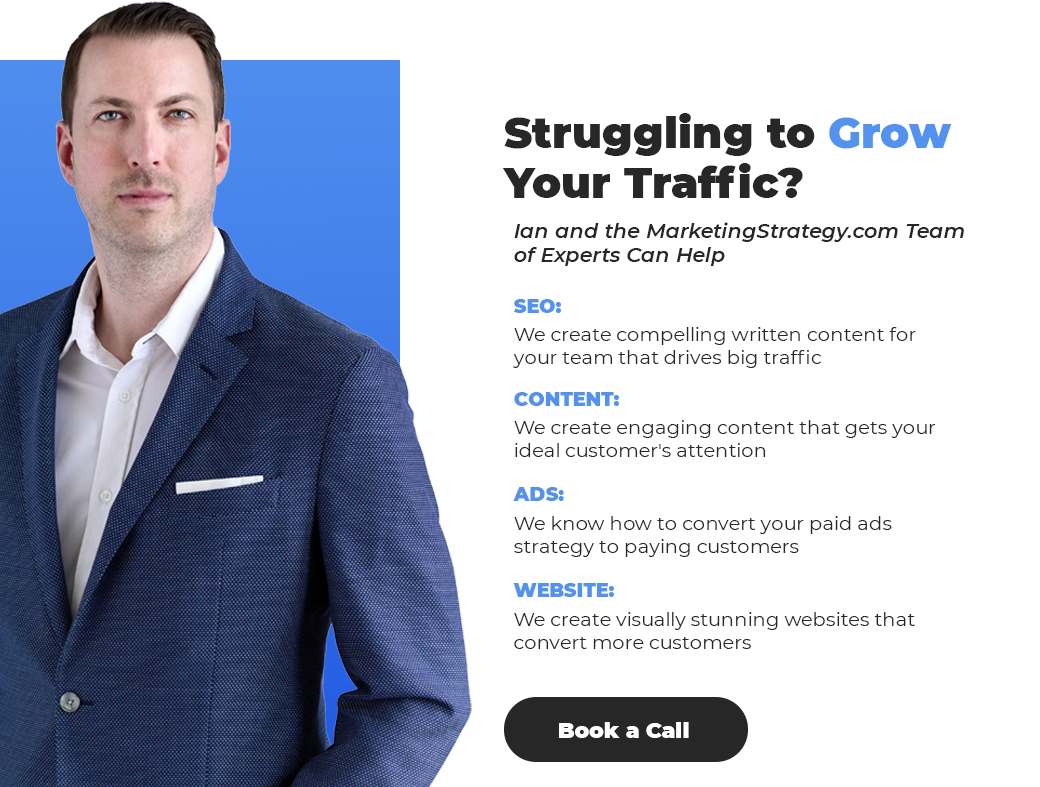

- Marketing – having a great offering at a great price does nothing if it is not promoted effectively to the right markets in the right way.

Leave a Reply